Moving RSU Proceeds to IBKR Without Paying ₹ 3-4 per $ Forex Mark-ups

6/19/2025

TL;DR – Add your IBKR ACH account as a “bank” inside Shareworks, push the USD proceeds directly, and fund your IBKR USD-denominated account inside India’s USD 200 k LRS window without ever converting to INR.

1 · Why bother?#

- Shareworks lets you “Sell → Remit to local bank” – but Morgan Stanley’s remittance partner often marks up USD/INR by 3–4 %.

- Converting back from INR to USD at your Indian broker or ICICI outward remit adds another 1.5–2 %.

- Interactive Brokers (IBKR India) accepts ACH Direct Transfers in USD from a US bank/broker account at $0 fee.

Net win: save ~5 % on every vest, and you keep the USD buying power to deploy into global ETFs (VOO, QQQ), US T-bills, or fractional FAANG stock.

2 · Pre-requisites#

| What | Where to click | Link |

|---|---|---|

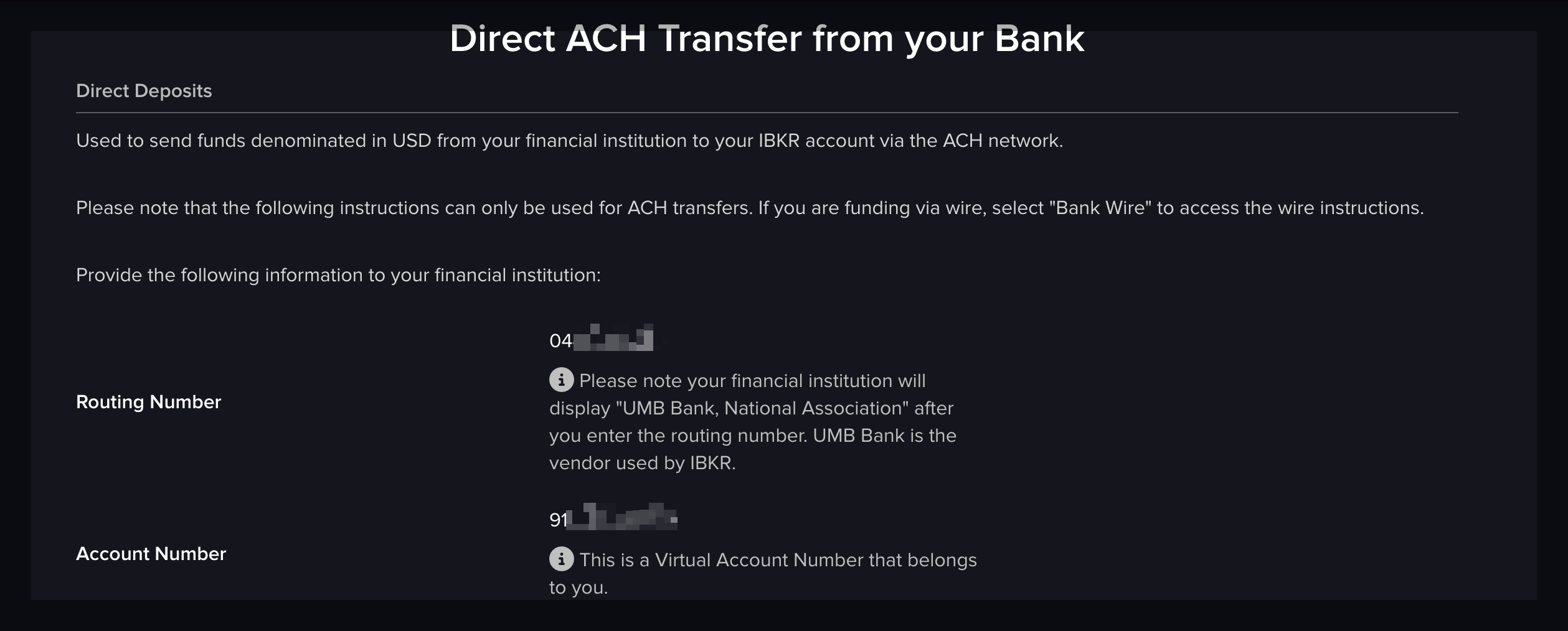

| IBKR account (INDIA) | Client Portal → Search for Direct Transfer → Deposit funds → Currency = USD → ACH Direct Transfer | |

| ACH routing + account number | IBKR shows something like:Routing: 074...Account: 1Z... | copy to clipboard |

| Shareworks login | My Profile → Banks | https://shareworks.solium.com/solium/servlet/ui/profile/bank |

Note: IBKR ACH is US-domestic only – Shareworks counts as a US broker so the transfer clears inside the US banking grid.

3 · One-time setup (5 min)#

-

IBKR → Deposit → ACH Direct Transfer → Save the routing + account numbers.

-

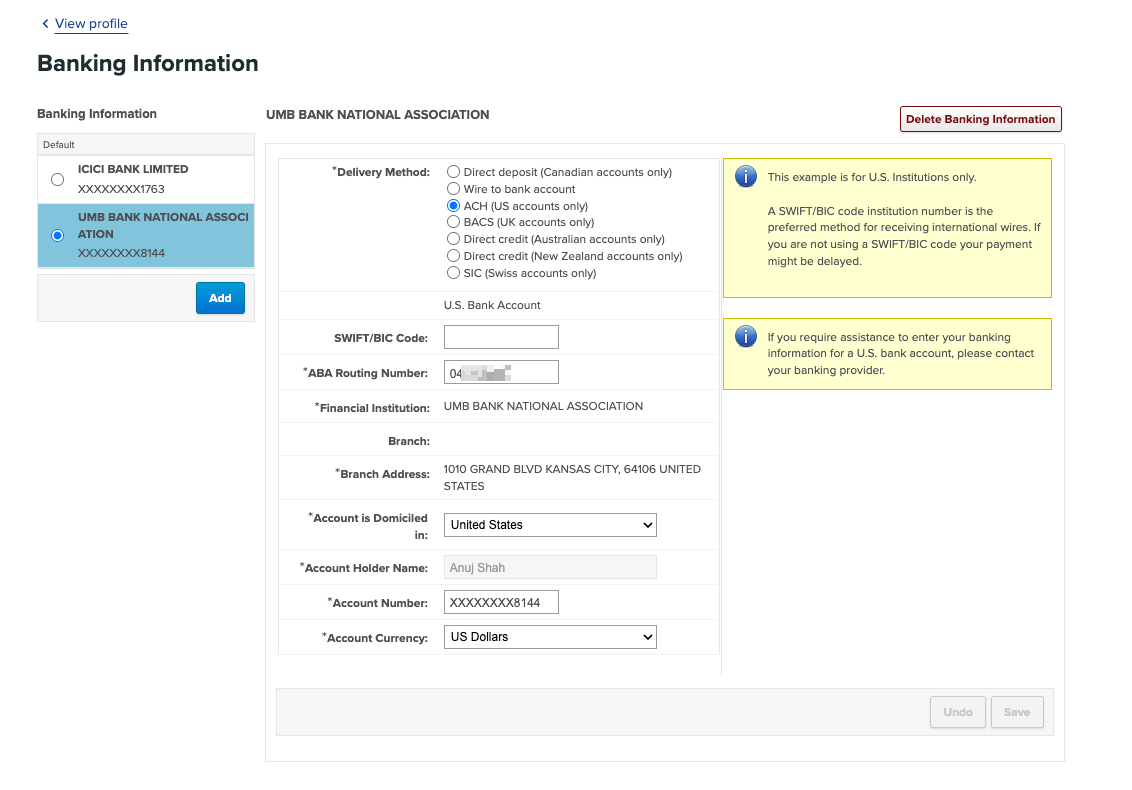

Shareworks → Accounts & Settings → Banking → Add Bank.

- Country: United States

- Paste IBKR routing + account numbers.

4 · Moving money every vest (two paths)#

| Path | When to click | UX |

|---|---|---|

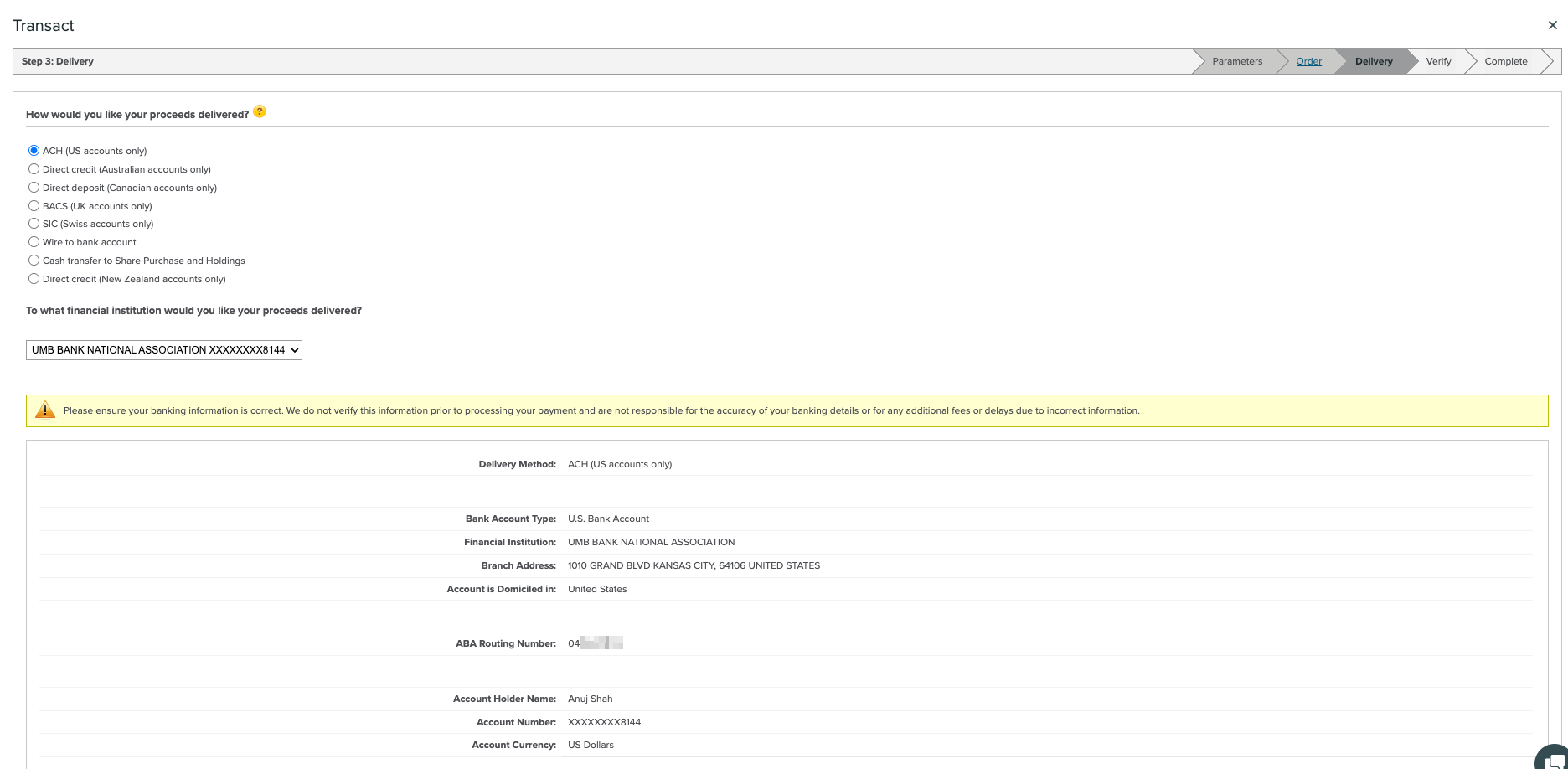

| A. “Sell & Transfer” | Right on the Submit Sale screen | Select newly-added IBKR bank → Shareworks wires net USD on the settlement date (T+2). |

| B. Bulk transfer | My Account → Cash → Transfer Cash | Pick IBKR bank, input amount (best to start with $10 to test). |

Speed: 3–4 US business days from settlement to IBKR credit.

Fee: $0 both sides.

RBI compliance: Amount still counts toward USD 250 k LRS yearly limit. Log it in your spreadsheet – the bank will ask at tax time.

5 · Buying foreign assets in IBKR#

- USD cash appears (IBKR “USD Cash” row).

- Place normal buy orders – US stocks, ETFs, even short-duration Treasury

Bills (IBKR symbol:

BIL,SGOV).

6 · Try with $10 first (seriously)#

Send $10, wait until it shows in IBKR, then move the real vest. That confirms:

- ACH details were typed correctly

- Your company didn’t restrict external banks

- IBKR auto-matches the incoming name

A one-time sanity check beats sweating over $40 k stuck in limbo.

7 · Don’t have an IBKR account yet?#

If this guide saved you a few rupees 💸 you can say thanks by opening your Interactive Brokers account via my referral link (we both get a small bonus when your account is funded):

No pressure—feel free to skip if you’re already set up.

8 · Key links 🔗#

- Morgan Stanley Shareworks help – https://www.shareworks.com/support

- RBI FAQ on Liberalised Remittance Scheme (LRS) – https://rbi.org.in/scripts/FAQView.aspx?Id=115

🏁 Wrap-up#

With one ten-minute bank-linking exercise you:

- dodge the 3–5 % conversion loss every vest,

- keep funds in USD for global compounding,

- stay fully compliant under India’s LRS.

Happy saving – and spend the forex fee you didn’t pay on something fun 🚀